change in working capital formula excel

The definition of working capital shown below is simple. Easily make entire column capital or lowercase in Excel.

Net Working Capital Formula Calculator Excel Template

Specify the number of days of receivables inventory and payables.

. Therefore the Change in Working Capital 200 300 100 so its negative and it reduces the companys cash flow. Below is a suggestion for. Working capital current assets current liabilities Working capital is important to businesses because changes in working capital can significantly affect cash from operations free cash flow and therefore the value of the business.

Increasing vs Decreasing Change in NWC. The Change case pane displays to the left of your worksheet. Net Working Capital Net working capital Working Capital Current year Working Capital.

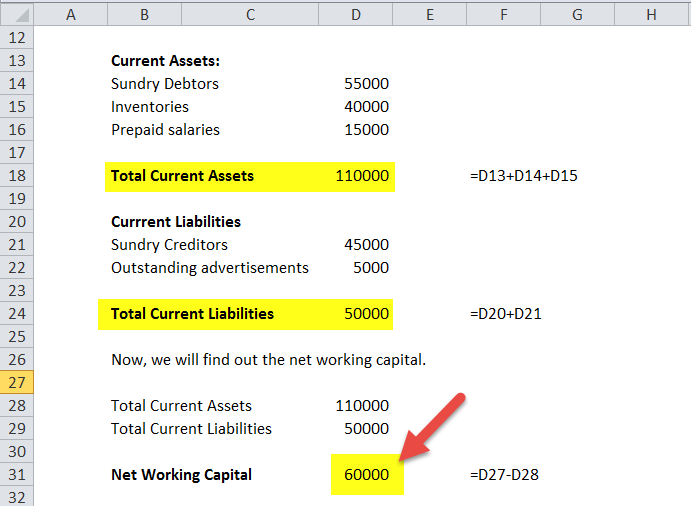

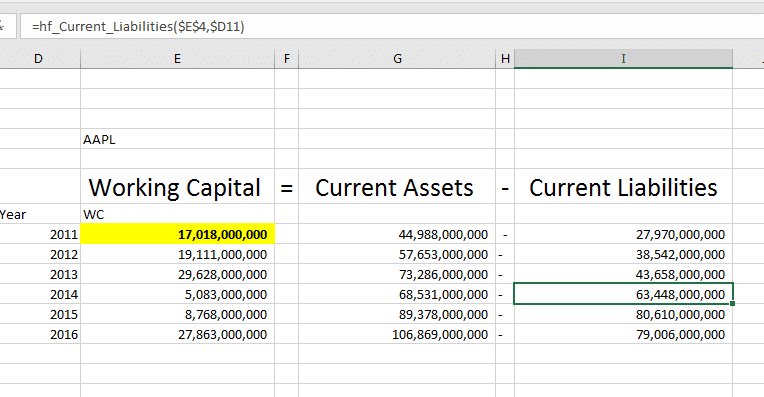

Working Capital Current Assets Current Liabilities. Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts Receivable Inventory Accounts Payable The first formula above is the broadest as it includes all accounts the second formula is more narrow and the last formula is the most narrow as it only includes three accounts. Type formula UPPER A1 into the Formula Bar then press the Enter key.

Current Assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses. When the company finally sells and delivers these products to customers Inventory will go back to 200 and the Change in Working Capital will return to 0. Now all letters in specified cells are all capitalized.

The easiest way to model working capital is to assume a specific number of days of receivables inventory and payables. Select the case you need from the list. Operating Cash Flow EBIT 1-t Depreciation and Non-cash expenses Or Operating Cash Flow Net Income Interest 1-t Depreciation and non-cash expenses Where EBIT is Earnings before Interest and Taxes.

It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a. It can be determined in two ways. Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

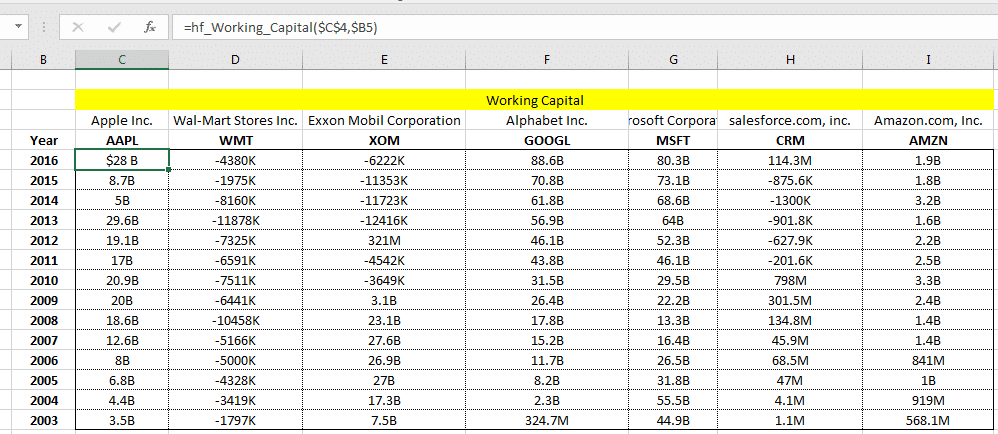

Excel-based Investment Research Solution for Serious. SP CAPITAL IQS EXCEL PLUG-IN v8x. Change in current assets can be generated by subtracting last period ca.

Change in Net Working Capital NWC Prior Period NWC Current Period NWC As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. Working capital Current assets current liabilities What makes an asset current is that it can be converted into cash within a year. FREQUENTLY USED FORMULAS BALANCE SHEET INCOME STATEMENT CASH FLOW STATEMENT.

The wrong way to do this is to calculate the working capital in year one from the balance sheet then calculate the working capital in year two from the balance sheet and then subtract to get the change. Change in working capital is a cash flow item that reflects the actual cash used to operate the business. Net Debt IQ_NET_DEBT Interest On Long Term Debt IQ_INT_EXP_LTD Change in Net Working Capital IQ_CHANGE_NET_WORKING_CAPITAL Total Capitalization IQ_TOTAL_CAP Total Current.

It is a measure of liquidity efficiency and financial health of a company and is calculated using a simple formula current assets accounts receivables cash inventories of unfinished goods. These assumptions can be derived from historical analysis in the case of an existing projectcompany or by finding comparables for new projects. Thus the formula for changes in non-cash working capital is.

Working Capital means those liquid funds whether in form of cash deposits in bank or in either way which is kept by an enterprise to manage the day to day running expenses of the business. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable AP accounts payable 2017 current period 2016 prior period Step 4 Capital Expenditures It is possible to derive capital expenditures CapEx. Press the Change case button to see the result.

Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital Change in Working capital does mean actual change in value year over year ie. Working Capital Turnover Ratio is calculated using the formula given below Working Capital Turnover Ratio Turnover Net Sales Working Capital For-Mar18 Working Capital Turnover Ratio 1842 -2554 Working Capital Turnover Ratio -072 For-Mar17 Working Capital Turnover Ratio 3173 -1886 Working Capital Turnover Ratio -168. With the help of Kutools for Excel s Change Caes utility you can quickly.

Change in working capital calculation formula. Drag the Fill Handle down to the range which you need to capitalize all letters. Change In Net Working Capital Formula Calculator Excel Template.

It means the change in current assets minus the change in current liabilities. We need to calculate Working Capital using Formula ie. Change in working capital Change in Inventory Accounts receivable Accounts payable.

If you want to keep the original version of your table check the Back up worksheet box. Click on the Change Case icon in the Clean group on the Ablebits Data tab. What makes a liability current is that it is due within a year.

The following steps provide additional insight into how to calculate net working capital. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period Change in Net Working Capital 12000 7000 Change in Net Working Capital 5000 Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities. A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in the future through the current ratio which we get by dividing current assets by current liabilities.

Best Excel Tutorial How To Calculate Working Capital

Net Working Capital Definition Formula How To Calculate

Net Working Capital Formula Calculator Excel Template

Change In Working Capital How To Interpret And Calculate In Excel With Marketxls

Change In Net Working Capital Nwc Formula Calculation

Net Working Capital Template Download Free Excel Template

Change In Working Capital How To Interpret And Calculate In Excel With Marketxls